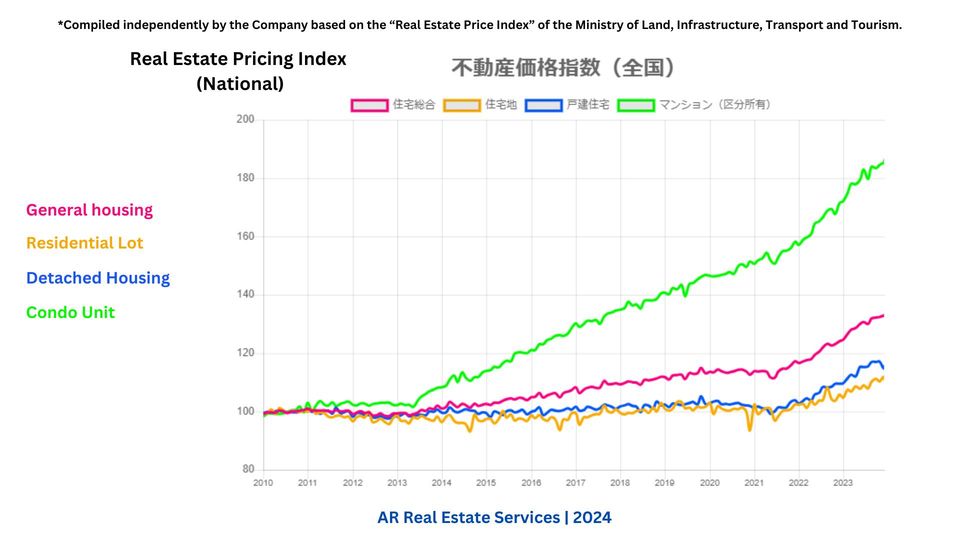

Price index

The price index for land and detached house real estate has risen by approximately 8–12% over the past five years. For condominiums, prices have risen by about 30%, and since 2010, they have increased by 89%. To break down the 89% increase, a condominium that cost ¥30 million in 2010 would now, in 2024, be priced around ¥50.67 million to ¥60 million.

When is the right time to buy or sell?

Buying Guide

Although the rate of real estate price increases is slowing, it is unclear whether prices will remain high or start to decline in the future. However, if inflation continues, interest rates may rise, which would also increase mortgage rates.

As a result, while waiting for inflation to stabilize, interest rates may rise, significantly increasing the total amount paid. Therefore, if you are considering buying a home within the next few years, it may be wise to act sooner rather than later.

In some regions, significant price increases might force you to reconsider your preferred area.

Currently, the Flat 35 mortgage, which was 1.34% before COVID-19, now has an interest rate of 1.95%. With additional options, it can rise to 2%.

While variable interest rates may increase, some banks are still offering competitive rates, such as 0.45% to 0.75%. A bank I frequently use has a campaign running offering a 0.29% interest rate reduction on new contracts.

Some buyers also need to consider in buying is the benefit the Japanese government offer like tax refund benefits for home buyers or limited cash benefits like Child raising families.

Tax refund benefit is set to end, cash benefit always changes yearly and ends when it has met the limited budget.

So please inquire and get assessed to check.

Selling Guide

When property prices are rising, you might think it’s not a good time to sell. However, since it’s uncertain whether prices will continue to rise or start to fall, waiting could be risky.

For example, a property that was purchased in 2023 for ¥42 million new, and by 2024, it sold for ¥65 million. In another case, a property purchased three years ago for ¥27 million sold for ¥34 million.

These results vary depending on the region, location, and market trends.

If you delay selling, the property’s age increases, and the building’s value decreases, potentially forcing you to sell at a lower price. Therefore, it’s best to act quickly if you are thinking of selling to start by checking your property market value to make it easier.

Land Price Announcement Shows Increased Growth

Will housing prices continue to rise?

On March 27, 2024, the Ministry of Land, Infrastructure, Transport and Tourism announced the “2024 Land Price Publication.” According to the report, land prices for all uses, residential land, and commercial land have all increased nationwide in the year from January 2023.

Additionally, in the road price announcement made in July 2023, the average residential road price increased by 1.5% compared to the previous year, marking two consecutive years of growth.

While urban areas show higher growth rates, land prices are also rising in rural areas, indicating a recovery in demand nationwide after the COVID-19 pandemic.

Curious about how these trends might affect your buying or selling decisions? Don’t hesitate to inquire—now is the time to make informed choices!